Best Suggestions For Choosing RSI Divergence Trading

Wiki Article

New Ideas For Deciding On An RSI Divergence Strategy

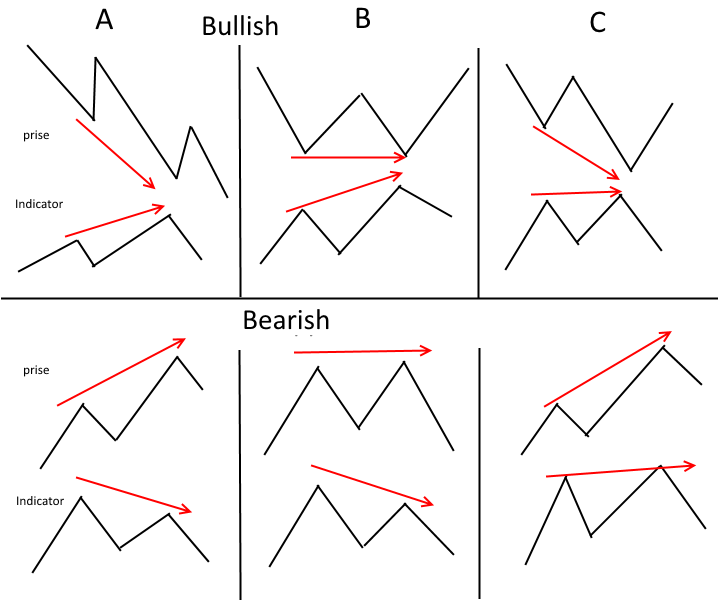

Ok, let's start by asking the most obvious question. Let's look at the meaning behind RSI Divergence really is and the trading signals we can take away from it. If your price action and RSI indicator is not in accord on your chart, there is a divergence. In this case, in an uptrend market, the price action is likely to make a lower low while the RSI indicators will make higher lows. A divergence is the time when an indicator does not agree with the price movement. This should be an indication that you must keep an eye on the market. As per the chart, both bullish RSI divergence and the bearish RSI divergence are clear and, the price action was actually reversed following both RSI Divergence signals, right? Let's get to the fascinating topic. Have a look at the best forex backtest software for site tips including position sizing calculator, RSI divergence, automated trading software, trading platform crypto, forex backtester, crypto trading backtesting, divergence trading, divergence trading forex, cryptocurrency trading bot, automated trading bot and more.

How Can You Determine Rsi Divergence

We employ RSI to detect trend reversals. This is why it is crucial to identify the most appropriate one.

How Do You Spot Rsi Divergence When Trading Forex

Both Price Action and RSI indicators both formed higher highs prior to the beginning of the trend up. This is usually a sign that the trend is solid. But at the conclusion of the trend, Price makes higher highs but the RSI indicator has formed lower highs, which indicates that something to be watched in this chart. Here we should be paying close attention to the markets as both the indicator's and price action are not in the sync. This means there is an RSI divergence. In this instance it is the RSI Divergence suggests a bearish tendency rotation. Take a look below at the chart to see what occurred after the RSI Divergence. The RSI divergence is extremely accurate when it is used to detect trend reversals. The question is: How can you identify an underlying trend? Let's look at four trade entry strategies that combine RSI divergence with higher probability signals. Read the recommended forex backtesting software free for site examples including best crypto trading platform, RSI divergence cheat sheet, trading platform crypto, best crypto trading platform, backtesting strategies, trading platforms, forex backtesting, best forex trading platform, forex backtesting software free, automated forex trading and more.

Tip #1 – Combining RSI Divergence with the Triangle Pattern

Two variants of the triangle chart pattern are offered. The ascending triangle pattern is utilized to reverse a downward trend. The other variation is the descending circle pattern, which can be used as reverse pattern in an upward trend market. Below is the descending triangle pattern. As in the previous example, the market was initially in an uptrend before the price dropped. RSI, however, also shows the divergence. These clues point out the weakness of this upward trend. Now we see that the momentum of the current upward trend has diminished and the price was capped in a triangular pattern that descending. This confirms that there is an upward reversal. Now it is time to take the short trade. The methods used to break out for this trade were exactly the same as the one previously mentioned. Now let's move to the third entry method. We will pair the trend structure with RSI divergence. Learn how to trade RSI Divergence when the trend structure changes. Check out the best bot for crypto trading for website examples including forex backtesting software, crypto trading, crypto trading bot, online trading platform, best crypto trading platform, crypto trading backtesting, backtesting strategies, crypto trading backtester, trading divergences, RSI divergence cheat sheet and more.

Tip #2 – Combining RSI Divergence Pattern with the Head & Shoulders Pattern

RSI Divergence can assist forex traders spot market Reversals. It can help make your trade more likely by combing RSI diversification with another factors that can reverse the market, such as the Head-and-shoulders pattern. Let's examine how to timing trades with RSI divergence and the pattern of head and shoulders. Related - How To Trade Head and Shoulders Forex - A Reversal Trading strategy. A favorable market environment is necessary before we consider trading. A market that is trending is preferred as we are trying to identify an indicator of a trend reversal. Check out this chart. Have a look at the top best forex trading platform for website examples including trading divergences, forex backtesting software free, divergence trading forex, best forex trading platform, online trading platform, crypto trading bot, crypto backtesting, best forex trading platform, automated trading bot, forex backtest software and more.

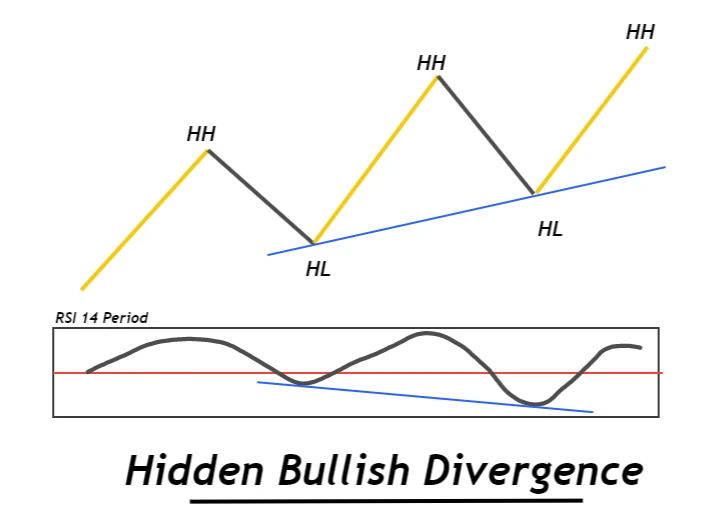

Tip #3 – Combining RSI Divergence with the Trend Structure

Trend is our best friend. We must trade in the direction of trend as long as the market continues to trend. This is how professional traders teach us. This trend isn't going to last forever. It is bound to turn around at some moment. Let's see how to identify reversals by looking at the structure of the trend and RSI divergence. As we know, upward trends are creating higher highs while downtrends are forming lower lows. Take a look below at the chart. If you look at the chart to the left, you will see that it's a downtrend. It is a series with lows and higher highs. Then, let's take another glance (Red Line) at the RSI divergence. Right? Price action creates lows, while the RSI creates lower lows. What is this implying? While the market is creating low RSI it is actually doing the exact opposite. This suggests that the current downtrend might be losing momentum. Follow the most popular software for automated trading for website recommendations including backtesting tool, automated forex trading, forex backtesting, automated trading, forex backtesting, crypto trading backtester, cryptocurrency trading bot, best crypto trading platform, trading platforms, forex backtesting and more.

Tip #4 – Combining Rsi Divergence In Combination With The Double Top & Double Bottom

Double top (or double bottom) is a type of reversal which occurs following a prolonged move or a trend. Double tops are formed when the price is at an unbreakable level. After hitting that level it will bounce down a bit, only to return back to test the previous level. DOUBLE TOPs happen in the event that the price bounces from the threshold. Check out the double top. The double top that you see above is a picture of two tops that resulted from a powerful move. Note how the second top didn't reach the heights of the previous. This is an obvious sign that a reverse is on the way because it means buyers are not able to move higher. The double bottom is also based on the same principals, but with a reversed approach. We will apply the breakout entry method. This is how we apply the technique of breakout entry. The price is sold when it is below our trigger. The price made our take-profit within a matter of days. QUICK PROFIT. The double bottom can be traded with the same strategies. The following chart shows the best way you can trade RSI Divergence with Double Bottom.

Keep in mind that this isn't your sole strategy for trading. There isn't any "perfect" trading method. Every strategy for trading suffers from losses. Even though we have a steady profit through this strategy We also employ a strict risk management as well as a swift way to cut down the losses. We are able to reduce the drawdown and open up the possibility of a great upside.